What the ‘One Big Beautiful Bill’ means for graduate borrowers and how we can help

Note: This post was updated on November 24, 2025 to reflect developments to the definition of professional degree

If you’ve gone to college in the last two decades, you’ve probably gotten used to one constant: Federal loans have been the backbone of how families paid for school. With the One Big Beautiful Bill (OBBB), that’s changing. The federal government is dialing back its loan program, and it’s giving students and schools a short window to adjust. Here’s what’s shifting, how we’re helping, and how you can prepare, especially if you’re thinking about graduate or professional school in the 2026-’27 academic year and beyond.

What’s changing?

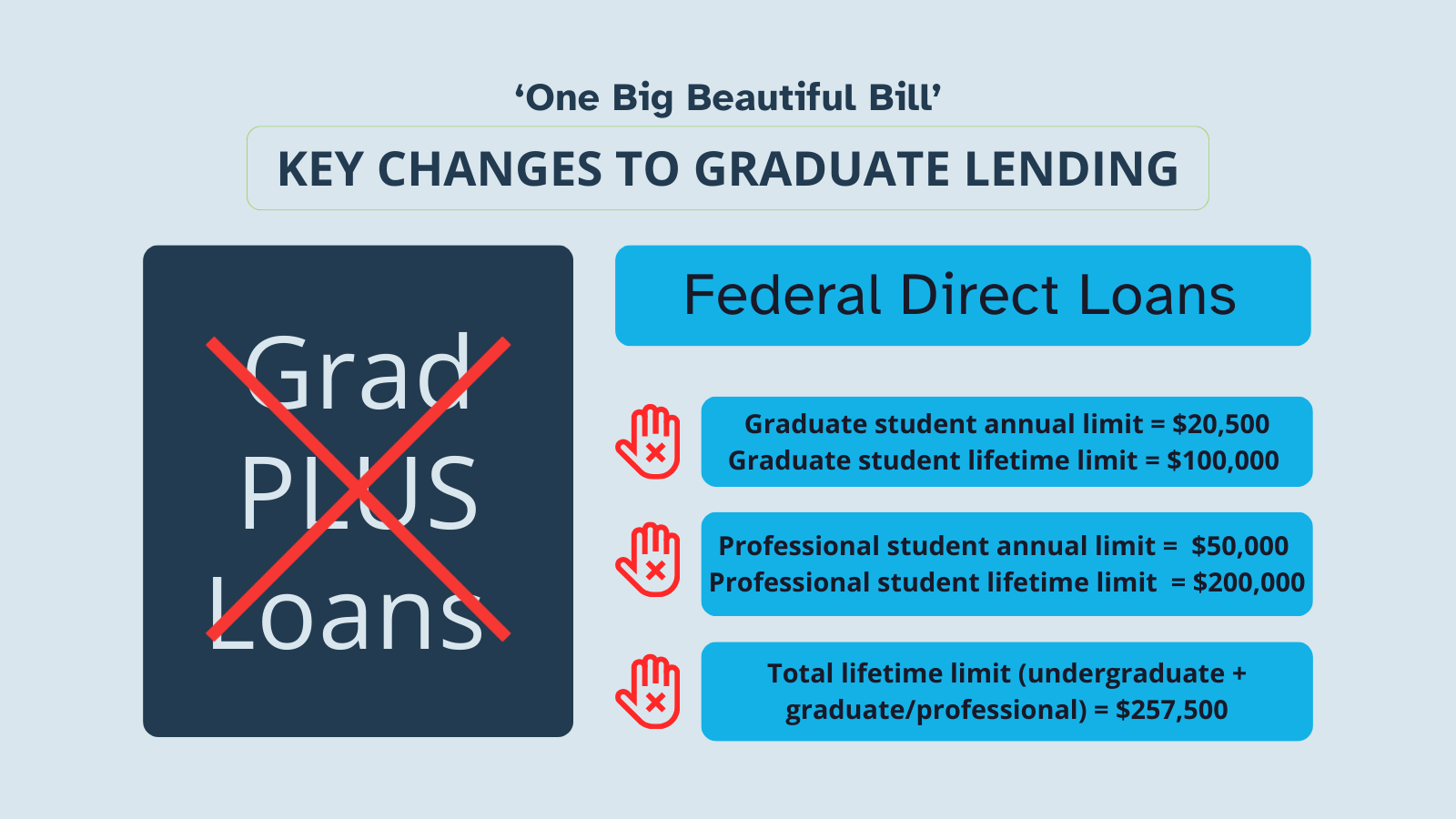

For years, graduate and professional students could use Grad PLUS loans to cover up to the full cost of attendance after tapping standard federal loans. Grad PLUS loans are federal loans that do not have a minimum FICO score requirement (however, applicants must not have adverse credit history); and while their interest rate is higher than Federal Direct Unsubsidized Loans, they historically had no lifetime aggregate borrowing limit.

Starting July 1, 2026, Grad PLUS loans will not be available for new borrowers (there will be a short transition window for students already in a program who have already received a Direct Loan for the program by the end of June 2026). Annual Federal Direct Unsubsidized Loan limits will be $20,500 for most graduate students and $50,000 for professional students. The lifetime aggregate limits will be $100,000 for graduate students and $200,000 for professional students, with total federal loan borrowing capped at $257,500 across all loan types for new borrowers. While the regulations to implement these changes are still in the process of being finalized, negotiators agreed on a revised and slightly expanded definition for a professional degree, which it appears will include the following components:

- Signifies both completion of the academic requirements for a given profession and a level of professional skills beyond that normally required for a bachelor’s degree

- Is generally at the doctoral level and requires at least six academic years of postsecondary coursework, including at least two at the post-baccalaureate level

- Generally requires professional licensure

- Is in one of 11 fields that have been accepted by the Department of Education, or a related field, as determined by the Secretary of Education

What the new law means for graduate students

In the past, federal loans effectively covered the gap between the cost of school and what students could afford. But now, with lower limits, many students will be left with unmet financial need. And without private lending options or institutional support, these students may be accepted into programs but ultimately be unable to attend — or worse, unable to finish.

This gap may be especially problematic for students in high-cost graduate programs such as medicine, dentistry, law, and some MBAs. International students and those without a strong credit history may also face gaps.

How to plan

If you‘re weighing a two- or three-year master’s, a four-year professional degree, or a program with extended clinical or research time, it’s a good idea to map out a plan now.

Talk with the financial aid office of the school(s) you’re planning to attend about the new federal rules and what they will mean for your program. Ask them for the full cost of attendance and any program-specific costs that don’t always make it into the posted number (equipment, clinical travel, licensure exams, required insurance). Then, list expected federal aid under the new caps for the year you will start the program.

If there’s a gap between your costs and what you anticipate you can pay under the new limits, it’s time to start exploring your options, including private graduate loans. Here are some tips:

- Have an honest conversation about credit. Many private loans are credit-based. If you have a thin credit history, a U.S.-based cosigner with strong credit can help unlock better pricing and increase approval odds. If you’re an international student attending in the U.S., a U.S.-based cosigner is often required.

- Look closely at interest rates and ranges. Federal loans use one fixed rate each year. Private and nonprofit loans usually post a range. For example, some private lenders advertise rates as low as 2.99%, but on the high end their rates can climb to nearly 15%, depending on the borrower’s credit profile. In some cases, only a small fraction of a percent of qualified applicants might receive that lowest advertised rate. Ask the lender what percentage of applicants qualify for the lowest listed rate.

- Compare options beyond loans. Some programs are re-examining assistantships, paid clinical placements, fellowships, and tuition guarantees. Ask the financial aid office how students in your program typically close the gap and what supports are available if costs rise mid-program.

Where Granite Edvance fits in

We’re a New Hampshire nonprofit that offers free college-and-career planning services and resources to NH families. We also offer private student loans nationwide, to both undergraduate and graduate students. Our rates are competitive but more consistent than some large lenders, with far less variability between borrowers. We do not charge an origination fee, and we offer helpful benefits including a choice of repayment terms and optional .25% discount for automatic debit.

- The Granite Edvance Private Student Loan is available to students who are NH residents or attending college in NH.

- The Granite Edvance Refinance Loan is available to NH residents who want to refinance existing federal and private loans.

We also offer private student loans for students and families outside NH. Learn about our EdvestinU loan products here.

Helping students and families cover funding gaps so they can reach their goals is part of our nonprofit mission. Plus, we’re here to support you throughout your journey!

Call us at 603-225-6612, email [email protected], or make an appointment at Graniteedvance.org/help.