Need help comparing financial aid offers?

Here are three options to fit different needs

Note: This blog was updated in February, 2026

Some people, when faced with a financial puzzle such as comparing financial aid offers, get a strange sparkle in their eyes and an irresistible urge to create a spreadsheet. You know who you are.

For the rest of us, thankfully, there are tools to make such tasks a little easier. If you’re getting ready to tackle financial aid offers and aren’t doing cartwheels about it, here are three great approaches to suit different needs.

First, a quick explanation of financial aid offers:

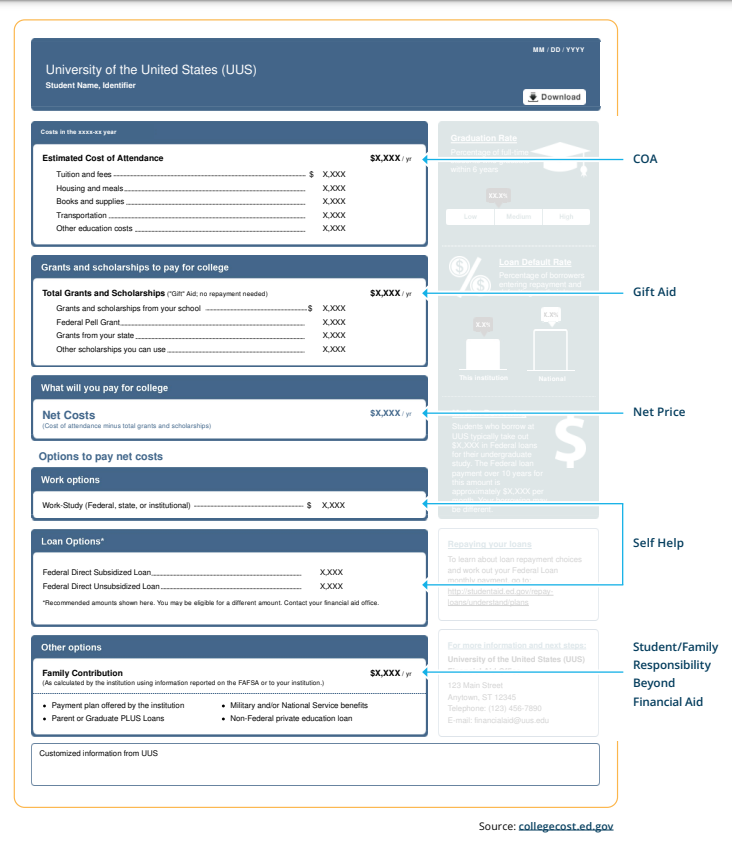

You will receive a financial aid offer from each college that accepts you as a student, provided you have submitted the required financial aid form(s). These offers don’t all look the same. For example, some list free money (grants and scholarships) separately from federal loan and work study options, while others do not. Comparing them can be confusing for many families. It’s not like you do this every day!

Try one or more of these options to gain clarity and confidence in making your college decision.

Talk it out with our team

Prefer chatting with a person? We offer free in-person and virtual appointments for reviewing financial aid offers. We’ll help you compare offers from all schools, calculate your bottom line, and consider your funding options.

“These appointments are really helpful for families who have specific questions or who are feeling overwhelmed by the process and need some support,” said Rachel Bibeau, Assistant Vice President of Pathway Services and Operations at Granite Edvance. “Our team has been doing this for years, and we also stay current on changes and trends to ensure we give families the most up-to-date information.”

Book an appointment here.

Go high tech with Award Advisor™

Looking for a super streamlined solution? We’re excited to share a new tool called Award Advisor™, a free app that creates a standardized view of financial aid offers that students can compare side-by-side. Developed by the Vermont Student Assistance Corporation (VSAC), a fellow nonprofit, Award Advisor also displays nonprofit lending options for families who face a funding gap. As an Award Advisor Network Partner, Granite Edvance will be listed as a loan option in NH, and our EdvestinU lending options will be listed in 28 other states. Read about it here.

Or get the best of both worlds and try a hybrid approach by using the Award Advisor app and then making an appointment to consider all of your options with a member of our team!

Do it yourself with this step-by-step approach

More of a hands-on problem solver? Here’s a step-by-step approach for comparing financial aid offers:

1. Find the total Cost of Attendance. If the Cost of Attendance is not on the offer, check the financial aid office’s website or call them directly. Remember the total Cost of Attendance often is more than tuition and room and board. Indirect costs like books, supplies, and transportation should be included in this number.

2. Note the scholarship and grant money first. Remember, this is money that you do not need to pay back. Just be sure you understand any requirements for receiving these funds, such as your college GPA. Subtract the grants and scholarships from the Cost of Attendance.

3. Review the federal loans and work study options you were offered. Remember, loans will need to be paid back with interest, and you are not required to accept them. If you do accept federal loans, subsidized loans are preferable to unsubsidized loans because the government pays the interest while you’re in school at least half-time.

4. Find the out-of-pocket costs for each school on your list. Combine the federal loan and work study options you’re planning to accept and subtract them from your net price. The remaining cost is your responsibility, to be paid from income, savings, private scholarships and, when necessary, private loans.

5. Carefully compare costs. After you’ve calculated your actual costs for each school, it’s time to compare. Double-check that you’re comparing accurately (or get one of those your spreadsheet-loving friends to help), then determine which offer is the best financial package.

Of course, finances are not the only consideration when it comes to choosing a college, but getting an accurate view of your financial aid offers is a key step in the process.